The View from the Cigar Shop

Taking up Gillian Tett's Invitation for an Ethnographic Study of the US Economy in FT; Responding to Tooze's Zen-like Questioning

“‘Well in our country,’ said Alice…you’d generally get somewhere else—if you ran very fast for a long time, as we’ve been doing.’ ‘A slow sort of country!’ said the Queen. ‘Now, here, you see it takes all the running you can do, to keep in the same place.’…The Red Queen effect refers to a situation where you have to keep on running just to maintain your position,” Acemoglu and Robinson in The Narrow Corridor.

“The task [of reproduction in Red Queen world] is politically assigned to the citizens of the ‘active society’…the late-modern individual becomes a ‘perpetuum mobile’: an actor who not only cares for him-/herself but also for the economic and social reproduction of the system, and who can never be sufficiently active and mobile nor ever show sufficient initiative. In this figure of the ‘active citizen’, the imperative of growth and expansion inherent to late capitalist modernity is effectively privatized…[entrusting modernity these individual agents] generates new sorts of legitimation problems for the state in the wake of the economic and ecological double crisis,” Harmut Rosa, Dorre, and Lessenich in The Escalatory Logics of Capitalist Modernity and the Crises of Dynamic Stabilization.

I have not written about the U.S. economy, except very generally when evaluating the trajectory of the overshoot, for almost two years now. It’s interesting to revisit that piece from 2021 because it aligns with how my thinking has changed more generally. As I wrote in my 2022 year-in-review, the salient difference between writing in 2021 and 2023 is in 2021 I looked out at the world and knew exactly what I thought about it. Every point thereafter feels like a bizarro world in comparison, where theory offers no edge. That is not to say that insights cannot be revealed about the bizarro world, but they are not principally explained. There is simply no way to make heads or tails of the data, which is so entangled it says two things at once, until a deeper look under the hood has begun.

The entanglement issue is captured nicely in the growing discrepancy between hard and soft outlooks, real business plans and attitudes regarding the operating environment. Which indicator is conveying the information that appropriately describes reality? Well, it depends on your position in that reality. The macro crowd, everybody from Kyla Scanlon to Noah Smith places their chips on the hard indicators. The soft outlook is at best vibecession and at worst partisan gun-slinging.

I’m sympathetic to these views. The frying pan chart demonstrates that after 2008 policy struggled to keep up simply with the economic problem of the global risk society against the advice of enlightened macro from Paul Krugman to Christina Romer. All of the sudden, facing the double crisis of 2020, enlightened macro found that it no longer had to run up a formidable hill—as Rahm Emanuel lectured in 2008 no numbers with trillions—to solve the economic problem. But that room to move provided policymakers with little reprieve because the goalposts had shifted since 2008, as suggested by the opening reference, escalating logics of capitalist modernity.

The intriguing aspect of Tooze’s review of the macro discourse is that, similar to Delong in Slouching Toward Utopia, is that the master descriptively projects confidence, but concludes in zen-like fashion on a question. We, the enlightened academics, policymakers, and even opinion columnists, have succeeded fantastically in pushing for the economic reality we now inhabit. Then why does it feel like that success has failed to gain currency among the broader public? When economic expertise is not treated with outright derision from this segment—what is it that you do exactly? —it is assumed to serve the priests of power. In this respect, the second position favoring the soft outlook I simplify as the political theory camp. Benjamin Studebaker, who explicitly features the anxieties of small business in his account of the American political crisis from the tradition of political philosophy dating back to ?Plato just as confidently asserts that the way is shut, at least until a Tolkien hero emerges to show the way.

So which is right? The machine1 is humming along and we are well on the way to building the fully electrified future to meet steep decarbonization targets for the coming decades and fulfil the promise of the abundance agenda, as the macro crowd asserts? Or is the machine so deeply impaired the macro crowd fails to spot the deviance, because the portion which needs to speak up lacks voice within the machine? Neither is right. And neither is wrong.

But we will not end on this zen koan. In this post, I will commit myself to an exercise which will explore the near-term prospects of recession. It will also consider, as you will soon see by my regional categorization, the possibility of prolonged recession for some and business-as-usual for those fortunate enough to belong to the perpetual motion machine of the consuming classes in coastal cities. In short, I will take up Gillian Tett’s call to action for an ethnographic study of the economy to make sense of the widespread discontent amidst an economy which has comfortably outperformed all counterfactuals as well as most of the developed world. Implied in the ethnographic Anthrovision is to go beyond the anecdotes relied on by Tett’s FT colleague, Ed Luce, column on the same topic, while also not taking the familiar path of suffocating in disciplinary formalities.2

The inclination is to drill down to the level of the “cigar shop”. The cigar shop is not a literal cigar shop as Wallace recounted to his dinner partner in My Dinner with Andre (very possibly the first ever podcast), but a stand-in for an approach which insists on open-minded investigation at the lowest level of complexity. The polycrisis, in all its glorious technicolor, is irreducibly perspectival. Though, it is also true that due to fractal nature of complexity, observing the essential signals at eye level may also reveal something of synoptic reality. In the Hayek lecture at the LSE this year, Tyler Cowen speculated how AI might spark a sea change in social science in this vein, beginning with “an Alaskan fishing village” to understand the social networks at the basis of a simple economy, and scaling up to “Belgium”.

I’m not particularly troubled by the possibility that this knowledge might never scale to “Belgium” because I believe more than Cowen does that insight must be mediated through human senses. A recent book, Madsbjerg’s Look, argues in favor of methodological inclination which leans into applying full range of human senses, neither too small nor too large, the space between the self and the world, the intersubjective. Tsing, in a book I strongly endorsed in my year-in-review, proposes a different term for these spaces in between, the arts of noticing.

The map of the face of Half Dome is a useful description the climbing paths to free soloist Alex Honnold, precisely because it fails to detail every crevice in the terrain, to say nothing of the weather or other factors he must consider when making life-or-death decisions. Crucial to the travails of unassisted rock climbing, navigating uncertain business climates, and modern macroeconomic management is there is undeniably a realm of sensation which must be evaluated alongside traditional ways of knowing. Discounting these sensations from climate doom to the imprecise sense of acceleration which I suspect is driving the mental health crisis is a recipe to realize Polanyi’s prophecy. That is, to gain a “modern” market economy but deprive it of value because in the process it has destroyed the mental substance of man and transformed his surroundings into a wilderness.

Emergence: Reality as I See it at Eye Level & Mediated Though my Headspace

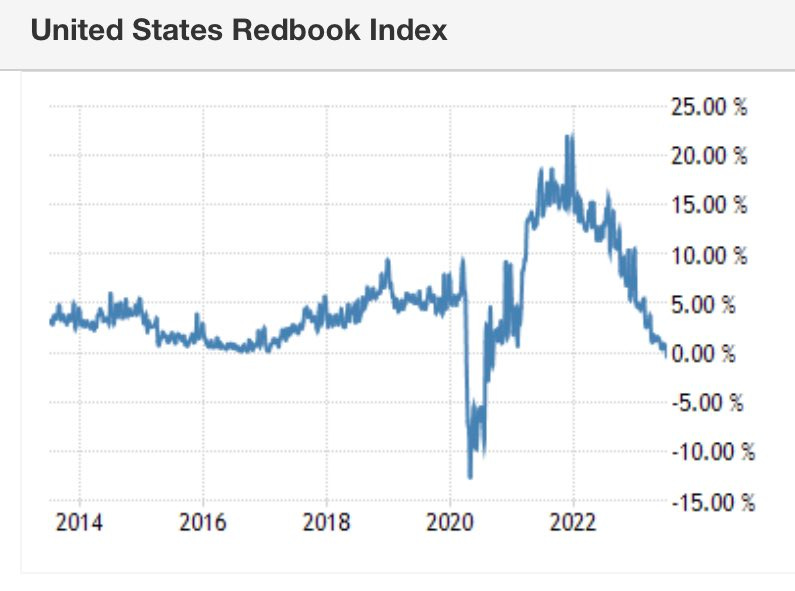

Suffice it to say that the only piece of information that can be revealed about the business in question is that volume of sales is a function of discretionary income which more or less tracks the redbook retail sales indicator. The general outline, though by no means uniform, is that it shot up when Americans for first time collectively shored up their savings in 2021 with emergency income supports, got knocked down in 2022 when those savings dissipated due to real wage pressures, and mostly disappeared by 2023. For what it’s worth, when this index was closing in on zero, the essential macro commentator, Steven Hou, joked on Twitter that recession had arrived. Costco is empty!3

In any case, the purpose of this post is not to write an industry report but to create an outline of analysis which should look familiar enough to anybody in the global polycrisis space so as to invite further reflections in like spirit but from perspectives shifted as much as 180 degrees.

From 2021-23, let’s divide sales into 4 quarters. Since Q1 and Q2 have 2023 sales numbers, they will have two reference points going back to 2021 when the above chart peaked, while Q3 and Q4 only have the 2022-23 YoY change. Let’s further subdivide the quarterly changes by regional categories, again generalizable to ascendant political economy to knowledge economies everywhere:

Wealthy Coastal: Roberto Unger calls this segment the vanguard of production. Productivity here is extraordinarily high, and knowledge economy workers command salaries which accord with their productivity.

Less Wealthy Coastal: The vanguard still resides here, but is hampered by political economy. My favorite example is a simple regression for amount of city area dedicated to parking spaces and salaries commanded by leading edge sectors, sliding down as cities choke in cement.

Wealthy Non-Coastal: The vanguard of production is mostly absent, but there is plenty of guardian labor, predominately in the FIRE sectors, its tentacles extending everywhere, which peripherally (and arguably, parasitically) serves the vanguard.

Home Base/Main St: This area is difficult to draw simple conclusions from. In international trade, gravity models are often robust. Similarly, the density and salience of social connections is often greatest in proximity to the base of operations. Sales might be scaled back generally, but expanded locally because the business owner can operate flexibly here to compensate. It also just so happens that Region 1, Wealthy Coastal, is the furthest away. Since the distance term is squared, an observer might predict that of the two avenues for expanding operations, the business owner would dedicate more attentional resources to the home base than the coastal metro, even though the customer base is mostly tapped in the home base, and a bottomless pit, Weber’s centipede which consumes without thinking, in the latter.

The home base struggles more than it should because the vanguard refuses to accept their responsibility for inclusivity, leaving intellectual property that could uplift Main Street restricted. To paraphrase Orwell, they are not wicked in their refusal, or at least not altogether wicked, merely unthinking.

Educated Small Town America: This is only the part of small town America which does not lie along the coasts, in which case it falls in region 2. There are substantial educated energies to draw on from these areas, but for the most part they are uninterested in the ways the corporate world on the coasts transforms them into efficiency. This is Thoreau’s Walden. In the modern world, these regions are anachronisms, but they are kept going to some extent by generational wealth from the industrial, mining, and agricultural magnates who settled there centuries ago. Housing markets remain affordable, but pools of coastal money are circling these regions, threatening their future affordability.

Less Educated Agricultural America: Unlike region 5, this region cannot be said to be anachronistic to the current genesis of the capitalist world system, but it relates to it by salvage dynamics. The things which are produced here, largely by exploited immigrant labor, end up on the plates, walls, yards, and even corporate offices of the center of the capitalist universe in Region 1. But the chain is often so complex that you would be excused for failing to spot the link. Awareness of the relation is expanding with intense demands to go Direct from the enlightened corners of the business press.

While welcome, it is impossible to read these accounts without wondering how in the world craft cultivation will scale on the level required to remove the intermediaries between the salvage centers, domestic and global, and the metropole. A familiar arc to many of these projects is a website is launched with the mission to remove exploitation and simplify the supply chain, only to discover later on that it turned into a marketing ploy to assuage the consciences of educated global upper class consumers. And in any case, the Direct agenda is not being driven by the salvagers. They recognize the labor they offer is the privilege to be exploited, and the year in year out exchange of people and products validate that privilege. Their request, too passive to be a demand but ought to be activated into one, is only that less exploitation would not stem those flows, but revitalize them, injecting unalienated creativity into the exchange.

The prediction is simply that while all regions might track the general redbook pattern in sales, spiking around May 2021 and continuing until early 2022, that you will see greater 2022-23 declines as we move down the list. It may even be the case that sales in the beating heart of the capitalist economy will see sales go up. Not incidentally, the beating heart also happens to be where the vast majority of data journalists articulating vibecession are domiciled.

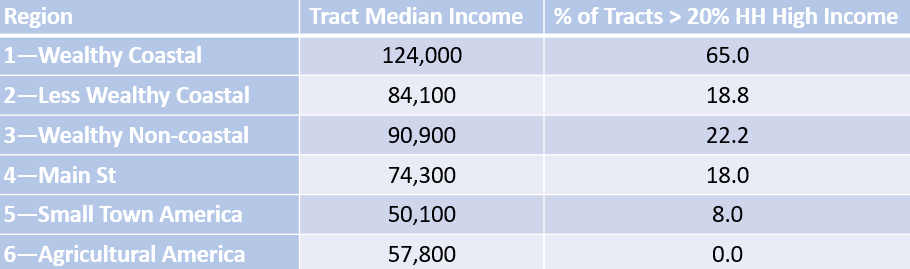

There is secondary prediction, which relates to which type of consumers spark a recession when there spending power is squeezed. A valid theory is that the U.S. has stratified into an hourglass economy, and economic performance therefore disproportionally depends on the continued consumption of upper middle class who have money to spend. Reports of mass layoffs at tech firms, and specifically the hammer of discipline on educated tech workers basking in their bullshit jobs, often reflect this theory of recession. To test the theory, I will geocode each of the businesses in the above regions with their census tract income data. Census tracts with median incomes over $100,000 or with over 20 percent making over $250,000 will get coded as high income. Notably, there are tracts in Region 5, Small Town America, which are high income but they are all of the hourglass type4 and there are no high income tracts in Region 6, Agricultural America. The vast majority of high income tracts are in Region 1, Wealthy Coastal. To get a sense of how my descriptions translate into hard income statistics, I have reproduced a few indicators below:

I think this table tells the same story as my blocks of text above. It’s interesting to me that median incomes don’t decline in step-wise fashion as move down column 2. I am most surprised by the jump from 5 to 6. I hear one of my Chinese professors at PKU on spatial economics, dumbfounded by the tumult of the American political scene, when I look at the $57,800 number (paraphrasing): “My wise American friends tell me that Trump is a regional backlash from those places left behind and viewed as economically backward. But when you look at the numbers the regional divide between prosperous and less prosperous is 2/1. In China, it often exceeds 10/1.” But keep in mind I did not look at all census tracts in these regions, only those tagged with business address data.

So now we can jump into the headline data which I should have led with.

The main purpose of presenting my findings in this messy way to demonstrate that micro and macro do in fact constitute the same reality. The macro reality above shows a brief moment as headed into the winter of the 2020-21, perfectly coinciding with 2021 Q15, where the American consumer was threatened, and it was a real question whether enough firepower was deployed to keep the economy afloat. The American Rescue Package was passed in March, and those questions were quickly forgotten. The Biden Boom shattered the legacy of the neoliberal epoch into thin air. The real effect on the ground floor of shoring up savings of the bottom half was nothing short of astonishing, an experiment I’m convinced will never be repeated.

Contrast column 3 from the left, near the baseline to be expected from Q1, with column 5. 2023 represents a roughly normal baseline for business activity and 2021 is, technically speaking, absolutely nuts. Marx once described capitalism as keeping up with a mad dance. The rhythm went especially mad at that moment. The efficiency of the disbursement into pockets on Main St was crucial. The lesson seems to be, if the goal is to maintain the 2021 baseline indefinitely ensuring that elite-mass relations are revived in long-run not simply staving off short-term recession risk, that financial security bodes well for macroeconomic stability. It’s the sovereignty of the good in action.

All good things are not good equally. An interesting observation with the particular story I’m telling is fiscal supports did not transfer into real savings equally and at the same instant. And it coincides with expectation. In Region 6, Agricultural America, the sales patterns show a delay—the “nuts” period was in Q1 2022, and did not rise with the general tide of Q2 2021. It’s an observation that’s worth filing away, and checking the major economics journals regarding regional discrepancies in timing and efficacy of the COVID emergency safety net. When these articles are published, they will surely make for excellent source material of book I hope is actually written, The False Dawn of American Social Democracy (2020-22). I imagine the drafters of that book pitch revolving it around a central question whether it is possible to build a social democracy in a country spanning the regional categorization I laid out. The most that can be hoped for is concurrent pockets of efficiency. In these laboratories, a wearied traveler could confuse a Region 1 local government with a tamed social democracy. He would have to be a time traveler in the Bellamy tradition, because to anyone with eyes who observes conspicuous urban wealth, U.S. social democracy as a work in progress is quite simply euphemistic.

The third loose principle is also related to the practical problems of delaying the good, not as a result of administrative leakiness, but a temporal tradeoff involved in acquiring it. Notice 2022 Q3 is excluded entirely from the above table. Infrastructural and operational upgrading is attentionally expensive, and involves immediately foregone revenues that can only be supported with access to credit. For businesses like this one, as significant as Bidenomics was to the environment they swim in relative to the anemic 2010’s of artificially depressed demand, it is not the most significant rupture with the 2010’s, particularly with, they often mention unprompted, prior to 2012.

The essential pillar of Bidenomics has little to do with demand management. Every President since the Council of Economic Advisors was founded after WWII has accepted the tenets of hydraulic Keynesianism, and some, notably Nixon, were even seduced by the metaphor of the Phillips machine. Biden was the first modern president, in effect reaching back to prior self-image of America not as a mature Rostowian country but one that is perpetually developing, who took a calculated gamble that the extension of credit would lead to more deepening of productive enterprise than boondoggles. As the subsequent term played out, he revealed his hand to be a gamble. Unlike many peer nations, there is little explicitly to stem nefarious credit once it is unleashed. Again, I would speculate this is related to its 19th century lineage.

The state of business creation and upgrading for Biden is as uncomfortable as the economy writ large. The boondoggles were revealed immediately, while nearly all the returns will come in after his term is concluded, and some will almost surely come to fruition when the political class Biden represents has long since retired and passed.

The development economist, Albert Hirschman, has two strains of thought which recombine in the Biden/Deese gambit. The first is that creativity, breaking the austere bonds of routine, is difficult to deploy but once deployed unleashes a logic that organically revitalizes. The classic hero’s journey begins with step 0 that something is not quite right in the ordinary world, that operations could be made more productive as evidenced by the fact that they are more productive in the other world of the vanguard. But the feeling is not the same as executing a plan of action. A helping hand is required for the hero to actually exit the ordinary world. Around the country, hundreds of thousands of business owners and their employees have taken Biden’s helping hand and are as a result exiting the ordinary world. They are heroes who will make the economy of the 2030’s immeasurably richer than the 2010’s. Depending on their dispersion, they may even facilitate regional convergence. This glimmer of balanced growth may still deliver where the demand side of the Biden agenda failed to strike a nail in the coffin of the escalatory stratification of neoliberal political economy. As Hirschman might say, we should use that glimmer as the raw material on the upward escalator toward social democratic wolkenkuckucksheim.

The image of Hirschman ascending to cloud cuckoo land reveals a double meaning. The popular conception of cloud cuckoo land to those who have no desire to visit is a weightless fantasy world that has no relation to reality. By that definition, the U.S. pairing social democracy with a balanced economy certainly hits the mark. From the key point in 2021 after the passage of the American Rescue Plan, high income areas are unusual in they are among the few places that have not seen steep declines in sales activity. At this granular level, extreme dependence on high-income households is less than desirable. Sensing this trend, the overwhelming tactical pressure is to expand operations where all the action is on the coasts, which the table shows is happening.

Though, the physical barriers remain substantial. The table does not show that the fraction of revenues from this growing part of the business is a fraction of the home base. It is often said that wealth is like manure, pile it and it stinks. The odor is a product of the furious activity brought to bear for expansion when a more efficient social-economic network would structure many smaller masses within a near range, not one gargantuan mass at a distant range. The physics of efficiency is important to emphasize as great energy is expended when operations are extended by these lengths with rewards which mostly do not justify that social cost. Mutatis mutandis the international arena i.e. trade wars are class wars.

The second meaning of cuckoo is intended for those who view cloud cuckoo land as a desirable place to live and actively seek out its insights. As the Romans said, nullum magnum ingenium sine mixtura dementiae fuit. Channeling the Romans, the business owner described Q2 2021 as “cuckoo”. Cuckoo is desirable because it transmits a signal. “Cuckoo” volumes transform that which is human and can be handled by human senses to that which is inhuman and must be assisted by digital tech and automated programming. The question that was forced on the business owner by the Biden Boom was how to unilaterally transfer low-productivity, high transaction costs patterns of behavior to their counterpart behaviors already practiced elsewhere. In their hands, the strategy is not anti-humanism dominant in the tech world. They are a liberation movement away from the 2010’s default of narrow control tasks in order to free up space for that which the spirit demands, understanding.

Humanism in the 2020’s, the Age of AI, is to unleash the 10,000 entrepreneurial spirits. When processes are sufficiently delineated, their mission, the concluding stage of the hero’s journey, is to spread those processes to other Main Street businesses. These experimentations have none of the raw materials to secure textbook vanguardism as their methods are imperfect and decidedly Hirschmanian in flavor. Shopify’s CEO articulated the fog of war, “we are arming the rebels against Amazon.” And thus we have gone full circle from Unger’s narrative, that the main site of capitalist modernity is not found in the vanguard, but in the spaces in between. They are the businesses who are ascending up into unfamiliar vistas with the assistance of Hirschman’s hidden hands:

Between Marx and Hirschman, Intellect and Will

The deeper question remains, as stated by Marx (or more precisely, Delong paraphrasing Marx): Does the nemesis of depression necessarily follow the hubris of overspeculation? A simple reading of my dataset would say yes, but in classic Marxist irony nemesis is avoided precisely by the people most responsible for the hubris. The dream world of March-April-May 2021 could not go on forever and was by definition unsustainable. When acclimated to that new baseline, regionally concentrated 20 percent declines can feel like a depression, if money is simultaneously made sufficiently dear. Certain segments of the financial world6, treated at most significant length by Chancellor in The Price of Time, are interestingly the most Marxist of all. In extreme versions of the chant, they insist that there is no alternative to pain (read: interest rate > inflation rate) as a result of the market froth which gained full steam up until the eve of the Russian invasion of Ukraine.7

I do not join them. Political nemesis in the form of Trump may very well come to pass. It bears repeating that the U.S. is a portrait of developing country, inclusive of political risks. Regardless of how 2024 ends for Biden and the Democrats, I’m more bullish on a timeframe that looks beyond the immediate political crisis. By 2030—an eternity I know which may amount to mere tempestuous seasons, I’m confident that the Biden legacy will be to have presided over a wave of empowering innovations. They are the kinds of innovations essential to a vision of inclusive vanguardism by making things simpler and more affordable. With the Code Interpreter plugin for ChatGPT, any small business can have a McKinsey consultant at their fingertips and all for the price of a HBO Max subscription. And while the fear that AI’s might replicate what is worst about McKinsey consultants can’t be summarily dismissed, the net effect of all prior empowering innovations was dramatic increases in productivity and job growth.

Therefore, Americans may soon be sitting in a future in which Biden is recognized as the president who reversed precarious work arrangements the Obama presidency did little to stop. The remarkable rise of manufacturing establishments post-IRA notwithstanding, Biden unfortunately has little data to point to on this deeper development which I believe is currently underway. So I must resort to where I started that sometimes you cannot discount what your senses are telling you at the level of the cigar shop. Nemesis will be ever present. After all, the 19th century history of the U.S. as a developing country is in significant part a history of depression. The disorderly arc of credit generation to fill the regional patchwork, a reminder that development is never finished, suggests that Hirschman will have the last laugh.

The link is Deleuze but it could have just as easily been to what I regard as The Greatest Story Never Told, riffing off the 60’s film on Jesus’ life to suggest there are other prophets of modernity who do not get their story told. I’m referring of course to the cyberneticians, “cybernetics is the science of control and communication in the animal and the machine…why communication… ‘being in control’ is absolutely dependent on the communication and the flow of information by which the thing is supposed to be controlled…in central nervous system, nothing ever changes [without communication] and same is true for machine as well…As to the animal and the machine….knowledge has been organized by tremendous division between animate and inanimate, physical sciences over here and biology and social sciences over. An acute divide, not supposed to be able to cross it at all…There are principles of control which apply regardless of whether you are talking about brains or computers…or for that matter economies and political systems or anything else. What these things have in common is that you have a very large probabilistic system which is whizzing around and somehow the “being in control” notion is achieved because of how it is internally organized and not because somebody came around with hammer, lever, or machine gun. Now apply that thought for even a second to economics….how control the economy? Control the money supply and that’s it! Like hell it is. The controls are implicit…market forces…devastating.”

See Christopher Leonard’s book on the extraordinary monetary policies undertaken in the 2010’s to compensate for straightjacketed fiscal policy and the cumulative fallout, notably disagreement between Bernanke and Dallas Fed President whether periods of emergency require policymakers to drop their tools.

Whether savings has disappeared is disputed depending on the particular statistical methodology is relied upon.

Hourglass type is less than $100,000 median income, but still get coded as high income because there is a significant plurality (>20%) of households that are very high income.

Quarters relate to reliable patterns in the seasonal activity of the business, and therefore deviate from conventional reporting.

On the Ezra Klein Show this week (Roge Karma is nearly as good of an interviewer as Ezra), Martin Wolf revealed why he characterized himself as a Marxist social scientist at his book launch, acknowledging that his early views on the likely course of inflation overweighted nemesis, “But my perspective has been that I got something importantly right and I got something importantly wrong, and the question is where this plays out.

I was one of the people who was concerned about the inflationary consequences of the pandemic quite early. I thought that the huge expansion of fiscal deficits combined with the huge monetary expansion of the 2020 and the continuation of that in 2021 created very severe inflation risks, and so I was relatively hawkish on this in 2020 and ‘21. And that proved to be correct.

And I argued this wasn’t going to be temporary in the sense that the Fed could just ignore it, so I supported the tightening policy. And I think it was broadly correct.

Now, I was one of the people who thought that once inflation began to be entrenched, particularly in labor markets — and you were seeing it in wages and earnings across much of the Western world — that it would be very difficult to disinflate smoothly without a rise in unemployment, and there were a number of others who took very similar views. And right now, it’s beginning to look as though that was too pessimistic.”

Melinda Cooper’s review of Petrou’s Engine of Inequality interestingly notes that those responsible for painting a progressive face on financial orthodoxy are often natural bedfellows with Marxists. Contrast that with a genuinely redistributive balanced growth agenda, which is, to return to Tolkien, the only way out. How to seize the reins of financial and monetary power from below?